Empowering Your Business with Fast, Flexible, and Transparent Funding Solutions

Alternative Business Funding That Moves at the Speed of Small Business

Quick Access. Simple Terms. Built for Business Owners Who Need Capital—Now.

At Business First Funding, we make alternative business funding simple. Whether you're covering payroll, buying equipment, or bridging a cash flow gap, we help small business owners secure the capital they need—fast, with no games and no hidden hoops.

Funding Timeline: Receive funds in 1–2 days with prompt document submission.

Alternative Business Funding That Moves at the Speed of Small Business

Quick Access. Simple Terms. Built for Business Owners Who Need Capital—Now.

At Business First Funding, we make alternative business funding simple. Whether you're covering payroll, buying equipment, or bridging a cash flow gap, we help small business owners secure the capital they need—fast, with no games and no hidden hoops.

Funding Timeline: Receive funds in 1–2 days with prompt document submission.

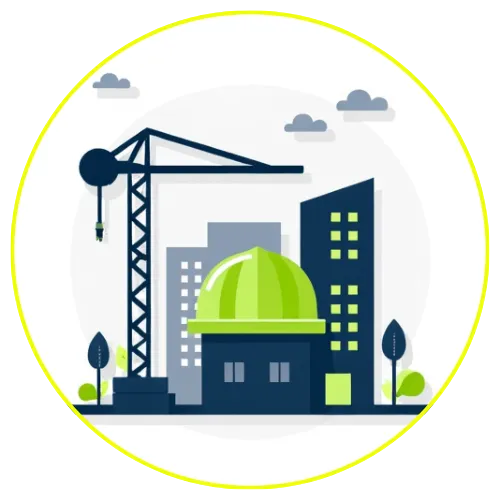

Break Free from Bank Delays with Alternative Business Funding That Works

Traditional lenders slow you down—long waits, endless paperwork, and requirements that make no sense for real-world businesses. That leaves small business owners stuck, missing growth opportunities because the cash just isn’t there.

Picture this: a critical piece of equipment breaks. Payroll’s due. A major client pays late. But the bank still wants three months of statements and a second signature. Meanwhile, your project stalls—and your momentum vanishes.

At Business First Funding, we do things differently:

Fast Funding: Capital delivered in 1–2 days with minimal documentation.

Flexible Terms: No rigid rules—just solutions built around your business model.

Real Support: Work with people who understand the grind and move with urgency.

We believe in helping small business owners take action—not wait around.

Your Funding Partner—Not Just Another Lender

Business First Funding helps small business owners access capital without the usual friction. We specialize in fast, flexible business funding that works on your terms—not the bank’s.

Whether you’re bridging a gap or gearing up for growth, we bring speed, clarity, and commitment to every deal.

We Fund What Keeps America Moving

We don’t deal in runarounds, rigid rules, or recycled loan terms. Business First Funding was built to serve business owners who don’t have time to wait—and shouldn’t have to.

Our approach is fast, human, and focused. We understand that when you’re facing payroll, a new project, or a cash flow crunch, the clock doesn’t stop. That’s why we fund based on business potential, not outdated underwriting.

Industries We Serve

You’ve built your business on hustle. We’re here to back that up—with capital that moves as fast as you do.

Here's How It Works

Funding in Three Simple Steps

1

Apply in Minutes

Complete a short, no-obligation application. It takes just a few minutes and requires only basic business info and bank statements.

2

Get a Same-Day Decision

Once we receive your docs, our underwriting team reviews your application—fast. Most approvals are issued within hours.

3

Receive Funds in 1–2 Days

Approved? Funds hit your account as soon as the next business day. No delays. No fine-print surprises. Just capital when you need it.

You keep working. We keep it moving.

Not a Bank. Not a Broker. A Real Partner.

Why Business First Funding

We don’t deal in runarounds, rigid rules, or recycled loan terms. Business First Funding was built to serve business owners who don’t have time to wait—and shouldn’t have to.

Our approach is fast, human, and focused. We understand that when you’re facing payroll, a new project, or a cash flow crunch, the clock doesn’t stop. That’s why we fund based on business potential, not outdated underwriting.

When the bank says no, we find the yes.

Fast Capital. Clear Terms. No Excuses.

What You Get:

1–2 Day Funding

Because next week is often too late.

Streamlined Application

One simple application. No paperwork maze.

Credit-Friendly Approvals

We look at performance, not just credit score.

No Hidden Fees

No balloon payments. No fine print traps.

Custom Structures

Daily, weekly, or monthly repayments—aligned with your revenue.

Direct Support

Work with funding pros who speak your language—and answer the phone.

Straight answers. Zero fluff.

Your Funding Questions Answered

What types of alternative business funding do you offer?

We offer options like short-term business loans, working capital advances, lines of credit, and equipment financing—each structured to meet different cash flow needs and business models.

How fast can I get funding?

Typically, funds are disbursed in 1–2 business days once we have your documents. In some cases, fast-track approval can accelerate the process further.

Do I need a perfect credit score to qualify?

Nope. We look beyond credit. Revenue, cash flow, business history, and collateral all matter. We accept businesses with credit challenges—tax liens, past bankruptcies, and dips in credit score are not automatic disqualifiers.

What’s involved in the application process?

It’s straightforward: fill out a short online application, upload basic financial documents (bank statements, revenue history, etc.), and that’s it. We’ll run the numbers and get back to you fast.

Are there hidden fees or surprise charges?

Never. We believe in transparent terms—all fees, rates, and repayment terms are shown up front before you move forward. What you see is what you commit to.

What’s the repayment process like?

It depends on the product, but typical structures include daily or weekly payments, fixed monthly payments, or revenue-share models for advances. Terms are built to align with your business’s cash flow.

How much funding can I get?

Funding amounts vary depending on your revenue, business model, time in business, and need. We often work with amounts from a few thousand to high six-figure ranges. Reach out or apply to see what you qualify for.

Can I use funds for anything?

Yes, broadly speaking. Many clients use our funding for payroll, equipment, marketing, inventory, growth initiatives, or bridging gaps in cash flow. If you're unsure whether your use case qualifies, ask us—we’ve seen most common needs.

How do you determine if I’m approved?

We use a mix of revenue metrics, bank statements, business history, and internal risk modeling—not just credit score. Our goal: find a funding structure that works for you without rejecting good businesses unfairly.

How long do you want to struggle with financial obstacles holding your business back?

Contact us today for a free consultation and discover how our alternative funding solutions can help you overcome these challenges and succeed.

We’re here to make accessing capital for your company as easy as possible.

Business First Funding is not a lender. We facilitate funding through third-party providers. Terms, rates, and amounts vary by applicant and provider. Funding subject to approval.

Copyright© 2025 Business First Funding. All Rights Reserved